If you are a citizen from another nation, you can still have the opportunity to get a mortgage loan to buy a property in the United States. The Foreign National mortgage loan program assists potential borrowers living or working outside the United States, looking to finance a second home or investment property only.

Similarly, applicants who are residents of the United States can obtain an individual tax identification number (ITIN), since they are not eligible for a Social Security Number. This allows them to report income taxes and apply for a mortgage loan. You can apply for an ITIN here.

Let Us Help You With an ITIN Mortgage Rate Quote

Borrowers Who Would Benefit From Foreign National

Non-Permanent Resident Alien

A non-permanent resident alien is anyone living in the United States without a green card but does have a Social Security number. Most of these people are in the United States for a certain period because of a temporary yet extended employment project. Even if their stay is temporary, purchasing a home in the United States may be more beneficial to them than renting. Once their project is complete, some keep the property as an investment or sell it to make a profit.

Visa Holders

A citizen of a foreign country who wishes to enter the United States usually has to obtain a U.S. via. This is placed on the person’s passport, which is issued by the traveler’s county of citizenship. Immigrant visas who are traveling to the States tend to have the intention of living here.

Borrowers Who Would Benefit From ITIN Loans

- Foreign buyers looking to purchase investment properties for rent or lease

- Buyers purchasing commercial properties such as offices buildings, apartments/condos, warehouses, hotels, etc.

- Borrowers with ITINs instead of social security numbers

- Homebuyer who is working in the United States on a visa (other than the B-1/B-2 visitor visa)

- US citizens who work overseas and earn income from their jobs in a foreign country

Foreign National Mortgages Accept a Variety of Income Sources

- Bank-statement loans for self-employed borrowers or those unable to provide a W-2 form

- Debt-service-coverage ratio loans for investment homes or income-producing properties

- Jumbo and super jumbo loans with higher down payment amounts

- Fixed- and adjustable-rate loans with terms of three to 30 years

- Loans for borrowers with no credit scores or nonprime credit

- Asset-based loans that require cash reserves but no proof of employment or income

Highlights For This Program

- Eligible Visa types: B1, B2, E, G, H, L, O, P, and TN

- No U.S. credit score or history is required

- Loan amounts up to $3 Million

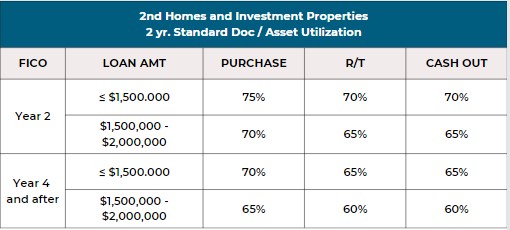

- Max LTV: 75%

- Interest-only feature available with no reduction to LTV

- Multiple qualification options

- 5/6, 7/6, 10/6 ARM, 15 Year and 30-Year Fixed

- Second home or Investment Property purchase transactions only

- Rate and Term or Cash-Out Refinance available

- A DSCR Program eligible at .75x

- No Ratio DSCR acceptable with restrictions

- Multiple-financed properties

- Non-warrantable condos may be considered