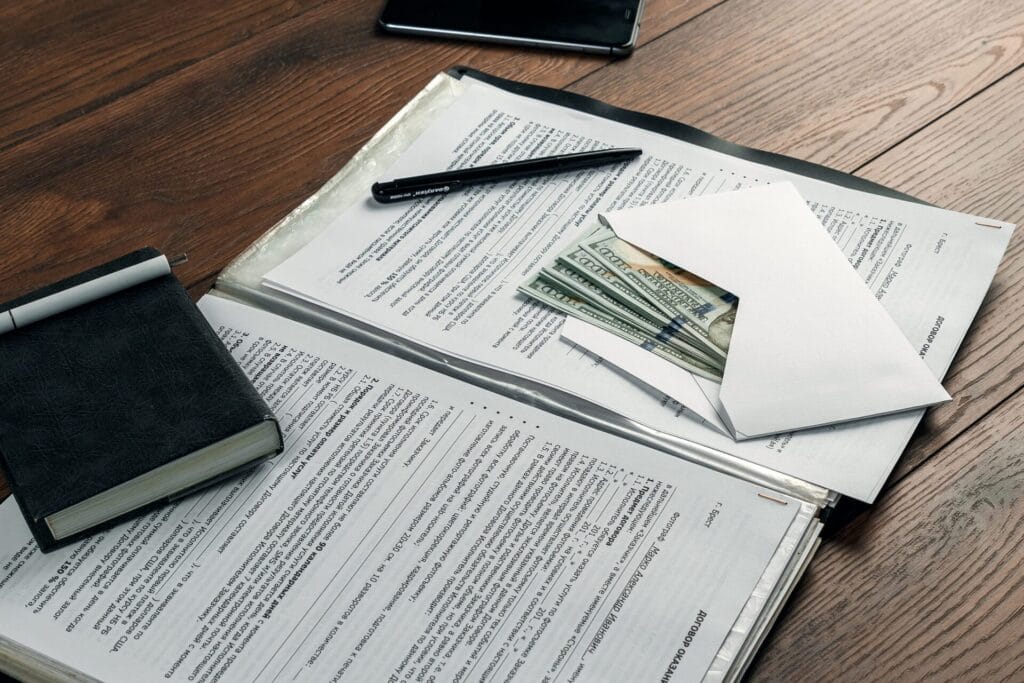

The downpayment for a mortgage loan is often the largest hurdle between a would-be buyer and homeownership. For this reason, many buyers receive cash gifts from relatives, using the money to jumpstart their purchase. But you may need to pay a gift tax.

If you are giving a large cash gift to help someone buy a home (or for any other reason), you need to understand the tax consequences of this generous act. By understanding the tax implications, you can maximize your giving potential while reducing the amount that must be paid to the federal government.

High Gift-Tax Limits for 2021

Note: We are not tax professionals, and the information provided in this article is for general information and entertainment only. The content should not be considered tax advice in any way. Before making a decision, speak with a knowledgable and qualified tax expert.

Recently, the Internal Revenue Service announced the official gift tax limits for the upcoming year. The announcement, which also included estate tax details, lifted the gift tax exemption from $11.58 million to $11.7 million for every individual. This means, essentially, that a single person could give up to $11,700,000 to the heirs of their choosing and pay no gift tax. A married couple can gift double that amount: $23.4 million.

Understanding How the Gift Tax Works

To fully understand the how gift tax laws work in the United States, you need to understand that the tax system essentially combines gifts you made during your lifetime with inheritances delivered from your estate at your death. Essentially, whether you do so before or after your death, any money you transfer to someone else could potentially be subject to a gift tax or an estate tax.

The IRS and federal government try to avoid taxing every single person on every small gift made throughout a year. For this reason, the government has allowed people to make tax-free individual gifts. The annual exclusion amount gives U.S. citizens the right to give individual gifts up to a certain point. Currently, that amount is $15,000. So if you only give gifts less than $15,000, it would not be subject to a gift tax. For example, if you gave four people gifts of $10,000 each, there would be no triggering of the gift tax. However, if you gave one person $40,000, there would be a gift tax.

Big Gifts May Still Not Trigger a Tax

Assuming all of your gifts are under $15,000, then you won’t have to worry about paying the gift tax. However, if make larger gifts, there are still areas where you won’t have to pay a tax. Gifts to spouses (who are U.S. citizens) or charities are usually not taxable, and gifts meant to cover someone’s tuition or medical expenses can be tax-free as well, as long as the payment is made directly to the educational or healthcare institution.

But what are the tax implications of real-estate focused gifts, especially the common downpayment gift?

In the case of a downpayment that will be used towards property, the basic $15,000 rule applies. If the gift is $15,000 or less, there is no tax penalty drawn from the gift.

However, if it goes above this amount, a payment will need to be made. Gifts over $15,000 are subject to taxation, and the gift must be reported to the IRS. The gift will be filed on the tax return of the person making the gift, the person receiving the gift.

Now is where the $11.7 million becomes a factor.

Gifts over $15,000 are added up over a person’s lifetime and offset against the exclusion on gifts, which for 2021 will be $11.7 million. The purpose, therefore, of filing the gift on the giver’s return is to track the total amount a person has given. This number will be used in calculating tax on an estate when someone dies. So if you give more than $11.7 million and pass away in 2021, the rate kicks in for all remaining estate properties, including cash savings and property. The remaining inheritances could be subject to a tax of roughly 20 to 40%, depending on many factors.

Remember: Only Family Members Can Give Downpayment Gifts (In Most Cases)

If you plan on giving a gift to help someone with a downpayment (or if you expect to receive one), you should remember that only certain family members can give gifts in most cases. There are rules saying that, essentially, only close family members can give gifts for downpayments. This is because gifts from a non-family member are more likely to have strings attached, so to speak. It could be a loan, or it could come with future financial expectations that could harm the borrower’s ability to repay.

Either way, you’ll have to verify that the gift is coming from a family member, such as a parent, adult child, or sibling, and you’ll have to prove, in writing, that the funds provided are not a loan.

What Will the Gift Tax Laws Look Like in the Future?

Laws are always changing, so it’s likely that in a few years, the specific numbers cited in this article could be outdated. The gift tax could go up, it could go down, or it could stay the same; we really don’t know.

Because there is lots of uncertainty, it’s essential that you meet with a qualified tax advisor who can provide the specific information on laws.

Get Experienced Support for Your Next Home Purchase

If you are using a cash gift towards your home purchase, let us help you secure a top-quality loan. We are experienced at helping people from all walks of life secure the best loan for their needs, and we will do everything possible to ensure your cash gift can be used as a downpayment.

In the end, this will increase your chances of purchasing a wonderful home for you and your family!