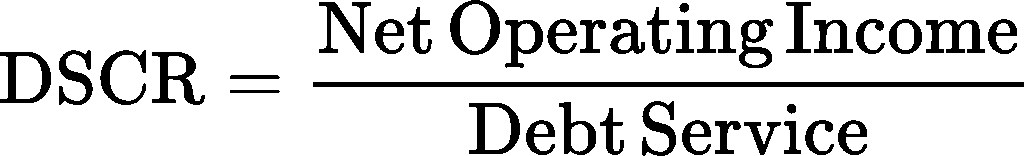

In the world of real estate investment, identifying financial metrics is key to making informed decisions and maximizing returns. Among these metrics, the Debt Service Coverage Ratio (DSCR) stands as a critical indicator of a property’s financial health and its ability to meet debt obligations.

DSCR serves as a vital tool in assessing the financial viability and risk associated with a real estate investment. A DSCR above 1.0 indicates that the property generates sufficient income to cover its debt obligations, providing a cushion for unforeseen expenses and market fluctuations. This surplus indicates a healthy financial position, enhancing the property’s attractiveness to lenders and investors alike.

Conversely, a DSCR below 1.0 suggests that the property’s income may be insufficient to meet its debt obligations, raising concerns for lenders and investors about the property’s financial stability, resulting in increased scrutiny, higher borrowing costs, or even reluctance to commit capital to borrowers.

Traditional methods of calculating DSCR however have often overlooked the unique income potential of properties engaged in short-term rental because lenders rely on historical long-term rental data to support their underwriting decisions. This often results in a declined loan application or requiring the borrower to increase their down payment. Moreover, the dynamic nature of the short-term rental market, including seasonal fluctuations and changing demand patterns, poses challenges in accurately forecasting rental income using conventional methods.

Enter AirDNA – a revolutionary platform providing comprehensive insights into the short-term rental market.

Unlocking the Power of Short-Term Rental Income with AirDNA revolutionizes real estate investment analysis by providing comprehensive insights into the short-term rental market. With access to a vast database of rental performance data, including occupancy rates, average daily rates (ADR), and revenue projections, investors can leverage AirDNA.co to enhance their DSCR calculations and make more informed investment decisions.

Benefits of Incorporating AirDNA Data into DSCR Calculations:

Chad Baker

Originating Branch Manager

NMLS #329451

858-353-8331

Licensed in: Alabama, Arizona, Arkansas, California, Connecticut, Delaware, District of Columbia, Florida, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Virginia, Washington, West Virginia, Wisconsin, Wyoming.

© 2025 San Diego Purchase Loans. All Rights Reserved. Disclaimers. Powered By CrossCountryMortgage, LLC