A bank statement program is an alternative to a traditional mortgage program where the borrower is typically required to submit two years’ worth of filed Federal income tax returns.

Challenge

Self-employed borrowers looking to qualify for a home mortgage through Conventional underwriting guidelines quickly learn that due to writing off much of their income when they file their taxes, they are unable to qualify for traditional home financing.

Solution

Our Bank Statement Home Loan Program is designed for homebuyers that are self-employed because it is based on personal, business, or profit and loss statements rather than tax returns.

I have been facilitating bank statement programs for self-employed borrowers since 2011. As the mortgage industry began to recover from the Great Recession of 2008, lenders began offering Bank Statement programs as financing solutions for self-employed people looking to purchase or refinance a residential property.

Before the Great Recession, the self-employed had only one option: A Stated Income loan, where the lender did not verify the borrower’s income. Stated income loans have since vanished, and in its place, lenders are using the deposits made into a business owner’s personal or business bank statements as the source of income to qualify for a home loan.

Bank Statement Loans and Fannie-Mae

- Seller-paid buydowns are permitted in accordance with Fannie Mae Underwriting Guidelines

- Bank Statement Loans are still run through Fannie Mae’s Desktop Underwriter; however, Approve/Eligible(A/E) Findings are not required.

It is estimated that approximately 16 million people in the United States are self-employed. Over the years we have helped hundreds of self-employed people purchase or refinance their first homes, second homes and even investment properties. A bank statement program is an alternative to a traditional mortgage which uses an average of two years’ worth of filed Federal income taxes.

Whenever I meet a self-employed borrower, we begin by looking at their tax returns for the last two years to determine if there is enough income claimed within the tax returns to qualify for a traditional tax return program using a one- or two-year average of filled Federal Tax Returns. From there we will look 12 months of the borrowers personal or business bank statements to determine the qualification using a bank statement program.

Question: How is Income Calculated for a Bank Statement Loan?

Answer: Income is Calculated by using Personal Bank Statements and/or Business Bank Statements

- Personal Bank Statements

Qualifying income is the total deposits divided by 12 or 24 months as applicable

- Business Bank Statements

There are four options for calculating income when utilizing business bank statements:

- CPA Letter for Expense Ratio

- Deposits Less Withdrawals

- Profit and Loss Statement

- Uniform Expense Ratio

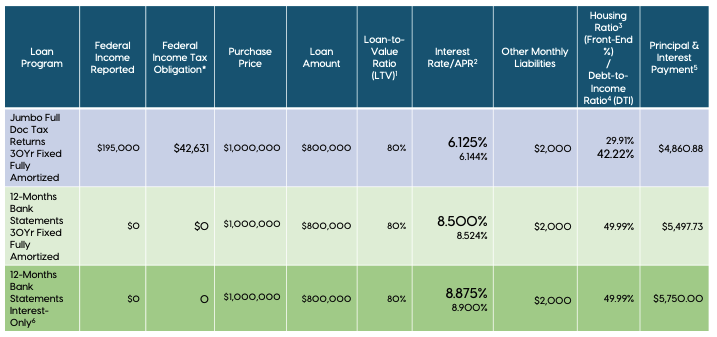

Traditional Full Documentation Underwriting versus Bank Statement Loan Program Example

I want to share a recent scenario of a self-employed buyer: Kristen owns a graphic design business and wanted to look at the differences between using a traditional home loan versus a bank statement loan program for the purchase of a $1,000,000 home with 20% down payment. Kristen has a credit score of 720 and $2,000 a month in minimum payments in other debts comprised of a car payments, two credit cards, and one student loan.

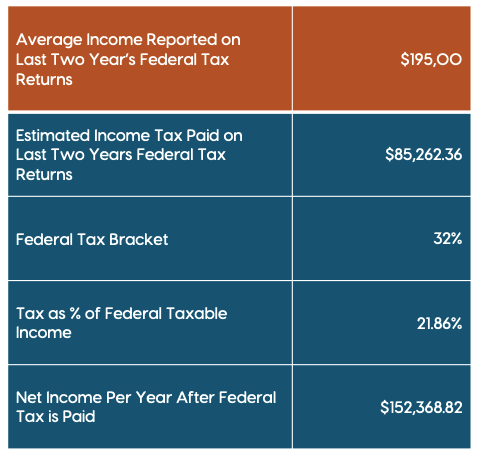

Traditional Underwriting

We were able to calculate that based on her existing debt, Kristen would need to claim approximately $195,000 in taxable Federal Income to qualify for a $800,000 loan. Based on a 32% Federal Income Tax Bracket, she would owe approximately $42,631 in Federal income taxes, approximately 21% of her required down-payment for the purchase of a $1,000,000 home with 20% down-payment or $200,000.

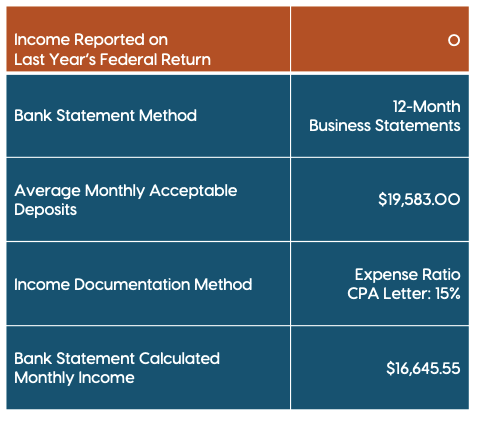

Bank Statement Underwriting

In comparison, a bank statement program will not require the review of any Federal Income taxes, since there is no requirement to document taxes being filled or paid.

Kristen was able to obtain a letter from her CPA that verified the following information:

- The name of the business

- Percentage of ownership

- Length of self-employment

- The business is active and in good standing

In addition to the items referenced above, her CPA indicated in the letter that the business entity’s expense ratio was 15% of the gross profits.

The Bottom Line

The monthly payment of a 30-year fixed fully amortized loan using a 2-year average of $800,000 at a rate of 6.125% (6.144% APR) would have a principal and interest payment of $4,860/month. In comparison the bank statement program would have an interest rate of 8.5% (8.524% APR) and a principal and interest payment of $5,497.73/month. The difference in monthly payment per month is $637.73/ month, but the difference in Federal Income Taxes Paid to qualify is over $85,000 going with a bank statement program.

For Kristen and many self-employed people, the difference monthly payment using a bank statement program was more advantageous and attractive than reducing her Federal Income tax write offs to claim enough income to qualify when her business deposits already documented more than enough income.

If you are self-employed and would like an analysis of your current ability to qualify for a traditional home loan using your filled Federal tax returns, please reach out.

Assumptions

These rates, terms, and calculations are being provided for educational purposes only. The results are estimates based on assumptions and general scenarios and may not reflect CrossCountry Mortgage, LLC product terms. The information cannot be used by CrossCountry Mortgage, LLC to determine a customer’s eligibility for a specific product or service. All financial calculators are provided by a third-party and CrossCountry Mortgage, LLC is not responsible for the results or the accuracy of the information. All loans subject to underwriting approval. Certain restrictions apply. Please keep in mind that we don’t have all your information. Therefore, the rate and payment results you see from this example may not reflect your actual situation. To get more accurate and personalized results, please call (858) 353-8331 to talk to one of our mortgage experts.

1Loan-to-value ratio (LTV), which represents the ratio of the loan amount to the value of the home. With an 80% LTV (20% down payment), you will avoid monthly private mortgage insurance (PMI) and may receive a lower interest rate.

2At a 6.125% interest rate, the Annual Percentage Rate(APR) for this loan type is 6.144%, not subject to increase after consummation. The monthly payment schedule would be 359 payments of $4,860.88 at an interest rate of 6.125% and 1 payment of $4,865.45 at an interest rate of 6.125%. This payment schedule is based on a $800,000 loan on a $1,000,000 property in San Diego County, CA. At a 8.500% interest rate, the Annual Percentage Rate(APR) for this loan type is 8.524%, not subject to increase after consummation. The monthly payment schedule would be 359 payments of $5,497.73 and 1 payment of $5,550.20 at an interest rate of 8.500%. This payment schedule is based on a $715,000 loan on a $893,750 property in San Diego County, CA. At a 8.875% interest rate, the Annual Percentage Rate(APR) for this loan type is 8.900%, not subject to increase after consummation. The monthly payment schedule would be 359 payments of $5,688.86 and 1 payment of $5,690.49 at an interest rate of 8.875%. This payment schedule is based on a $715,000 loan on a $893,750 property in San Diego County, CA. If an escrow account is required or requested, the actual monthly payment will also include amounts for real estate taxes and homeowner’s insurance premiums.

3Housing ratio, which represents the percentage of your total income that goes toward housing expenses.

4Debt-to-Income ratio (DTI), which represents your total debt payments, plus housing expenses, as a percentage of your total income. Lenders will typically look at any of these ratios as constraints, meaning once any of these ratio limits is reached, the amount of the loan will be capped.

5Monthly payment does not include taxes and insurance premiums, actual payment will be greater.

Repayment of a mortgage loan requires the borrower to make a monthly payment to the lender. The monthly payment includes repayment of the loan principal and interest on the outstanding balance. Loan payments are amortized, meaning your monthly payment remains the same during the repayment period, but the percentage of the amount that goes toward principal will increase as the outstanding mortgage balance decreases. Mortgage payments can include escrows, which are pre-payments of property taxes, homeowner’s insurance, and monthly homeowner’s association dues into an escrow account, managed by your lender. When those items are due, your lender pays the tax authority, insurance company or homeowners association, as applicable.